No Longer a Millionaire - My Whole Investing Portfolio (November 2022) and a 20% Return Every Month

- Feb 15, 2023

- 9 min read

Updated: Aug 3, 2023

Fresh off a HIGHLY EXTENSIVE RESEARCH DOCUMENT on Energy (which if I'm honest I didn't put in as much time as I should to understand), I told the client in question that one of the reasons it's a good time to invest is because Winter is coming. Because my client is extremely intelligent, he decided to do a quick check for himself and concluded otherwise, and I had no rebuttal as we sat in that dark restaurant. "I'm not seeing it," he uttered factually and coldly, as he highlighted portions of the graphs diving downwards on various years leading up to December. I felt pretty embarrassed.

So you can imagine my surprise when in December, I was compiling information for my course when an article recommendation popped up and I saw this.

It didn't add up to me, and so I did a quick google...

Well okay.

I'm not sure if it's a Singaporean thing but both the client and I assumed that winter was from October to December. I think it's because some old textbooks with spring-summer-autumn-winter just made you assume that it starts from Jan 1 and ends in December 1.

It's really embarrassing.

My point is that everyone has gaps in their knowledge, even if you're a subject matter expert. In my situation, I'd say that 2022 was where I had many gaps.

For those of you who want to see last year's full portfolio reveal, the link is over here and below. I'll be summarizing some of the biggest losses and the tougher lessons learnt.

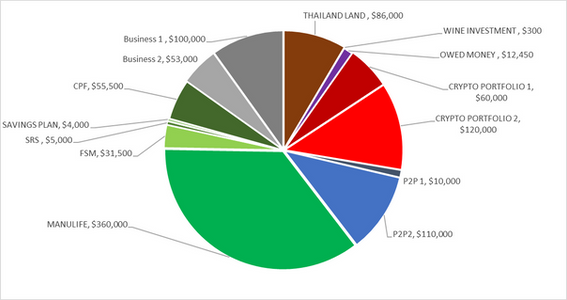

The Portfolio Summary

The above is my current portfolio value as of November 22, 2022 - almost exactly one year since the last time I did one of these. For context, the portfolio in November 20, 2021 is listed below, and you can read the full article here.

READ ALSO:

I can't seem to caption this picture for some reason, so it was $1,007,750.

Naturally, I'm no longer a millionaire. Yep.

Hmm...

I think it's ok. A bit bittersweet, but my life has been so blessed in the face of all the issues that I've experienced personally and professionally, that this is not even a serious concern.

Similar to the last review, many of the numbers are rounded up or down to estimate easier. There isn't too much difference between these numbers and the actual portfolio size (daily volatility could even it out).

This time round, I also included the differences between this year and last year so that I had a clearer idea of not just the impact of my investment decisions, but also the impact of my life decisions on the portfolio.

The labels are as follows:

Amount: The current value of the investment.

Initial Amount: The investment value at the beginning of the year, including investments made in the first half of the year.

Assumed Amount: The investment value of the businesses in particular, based on valuations in June 2022.

Loss/Gain %: Losses or gains expressed in %.

Numerical Loss/Gain: To quantify my paper losses. The only definitive loss so far is the land, since I gave it up. Some investments are also cash flow only and do not appreciate.

Several notes to account for:

1) The initial amounts are not the original capital amounts; they are just the previous year's numbers and amounts that were added to them.

To date, the Manulife Investment, FSM, CPF and all 3 businesses are still net profit from initial capital, but they may be losses compared to last year.

2) As usual, I do not consider cash or insurance in my portfolio.

3) This will be the last time I am recording the land investment. I have noted it in future article to elaborate on.

4) Some of my portfolio investments made in the later part of 2022 are not accounted for, since technically my track record of investments starts in April 2017. As such, I didn't count the investments made after that - frankly, I didn't have that much capital to deploy anyway.

With that, here's my portfolio and what happened/what I'd do better.

Manulife Investments/CPFIS/SRS [Bad]

It was hard to make a judgement call on moving money out of Technology initially because Tech investments had been fundamentally overvalued for many years, with reports saying as much coming out as early as 2017.

If you'd invested back then, you'd still have made money (and my own track record has attributed large returns to Technology). But I made a call to be permanently out of Tech for now as early as April.

The parts where the portfolio suffered the most was probably a combination of the timing and unexpected further losses on China. At one point, the portfolio was down as much as 43%, but it's been improving rapidly after Covid-Zero was relinquished. It is likely that by the time this article is published, my situation will have improved a lot.

Since Manulife, SRS and CPFIS all had very aggressive China investments, it wasn't a net positive for me.

Private Bonds [Good]

I added another $64,000 in private bonds. This was a big risk for me because my private bonds have been reliable for coming onto 3 years now and taking on another one seemed a little unnecessary.

Funny story - one of the new bond holders was so terrified about potentially failing meeting his contractual obligations that I got a phone call from his mother to reassure me that she would cover him if his business failed.

I really appreciated that sincerity from him to risk humiliating himself in order to assure me and fulfill his obligations.

The bonds do not appreciate but they pay out 1% in cash flow every month, which has been essential in my pivoting business during these high inflationary periods and making sure that I don't have to let go of any of my staff.

That's a 12% coupon a year vs even high rates of 4.5% in T-Bills, but I wouldn't recommend it for the people unexperienced in this space. Even I thought CoAssets would be safe at one point in my youth.

FSM [Bad, not counting post April 2022]

Most of my investments after April were in FSM and Manulife. Those have had positive returns, but everything before that has been negative.

Disappointingly were the China Investments for sure, but also some of the disruptive technology funds I had forgotten about. I really have no excuse for that because I had just forgotten about my FSM account when I was escaping Tech in April.

Businesses [Hard to Say...]

My Paddleboard E-Commerce Business (refer to last article) sold out recently and we collected a reasonable gross revenue. The tricky part is that high inflation has certainly affected sales and it was a struggle to sell the last units compared to when we first kicked off the business.

It was an unfortunate decision, but we're taking the revenue and pivoting into a new E-commerce venture.

Based on the mid-year valuation, one of the businesses I have a minority share in could be very valuable. I'm not crossing my fingers till I can actually exit though, and even then; I intend to exit for much more. The same goes for the most recent business I've acquired.

I don't think there's much I would do differently for now, but I kind of wish I'd just invested more into cash flow stocks. It's a lot of money for a long-term play with even more risk than funds, and I really have too much money going up and down in long term investments.

Crypto Portfolio

I saved the worst two for last, because Crypto has had a really awful year.

What's worse is that I was not even affected by LUNA, which notoriously lost 99.99% of its value from high. I never considered it an option, but I still got kicked in the face somehow from Ethereum, Cardano and Ripple. I have some accumulated investment experience in Crypto to the point that suggesting I couldn't have taken defensive actions isn't true anymore. So... the real reason was that it was pretty troublesome, and fees to enter and exit are high.

I think the real lesson there is that a lot of people invest with the mentality that you can always sell first and wait for the price to drop before buying again. It's easier to time the market with indices, but it's pretty hard when it comes to individual stock picks - and worse with transaction costs. You could wait years, or never recover from such an action. Still, I'll be holding and hoping for the best with reasonable belief that it'll bounce back greater and better.

Land [Bad]

Finally, the land in Thailand. Many longtime supportive readers and clients know that I purchased land with my ex, which I've written about fondly in articles like 'An Earnest Conversation' and '7 Financial Lessons I learnt travelling 1900km to surprise my girlfriend for Valentine's Day.' We built a house there as well in preparation for our future too. It was a meaningful and loving relationship for 5 years (for the most part) in which I have little regrets left. Without it, I wouldn't be as driven, competent or mature.

A good relationship humbles you and teaches you and molds you - which has made a very valuable case for me getting married in the future. I used to believe it was potentially optional, but now I see it as an inevitability. My initial intention was to sell it as promised, but because my ex and I parted ways somewhat amicably and I still loved her very much, I always figured that I would leave it for her and her family. I could always donate less to charity over the next decade. I also did consider that perhaps we could sell it at a better time and split the profits.

But as our attempt at friendship and perhaps reconsidering our relationship grew extremely strained, I also realized that it wouldn't be good for the loved ones in my life to have me consistently involved with the potential development and selling of the area over the next few years. I think anyone who's ever wanted to marry someone else would find that it would certainly bother her a lot if you had a very deep-rooted connection to your ex.

Or y'know, $86,000 worth of property. That makes for pretty deep roots.

I don't believe in shedding the past (e.g., deleting old photos) that made me who I am today, but I don't need to keep it in my present for her sake.

Alternative Investments [Wine] (Good...?)

I exited from my Wine investment at a small profit of $30 (initial capital $300).

I'll be honest - I'm not sure what I was thinking, and I would never do it again.

I wouldn't scale up this business because I don't quite understand or trust it (meaning I wouldn't do $30,000 capital instead of $300) but I also shouldn't do $300 again because it's not a good use of my time. I probably actually lost money in terms of relative income due to the time spent on the 2 transactions.

Sometimes when things are going well, like in 2021, you become susceptible to mistakes. READ ALSO: Her $6k salary is better than your $10k - Here's why

Final Thoughts and Making my Investment Comeback

So, there you have it. Despite almost investing a quarter mil this year, my stock portfolio is down about 30% and my total portfolio is down quite a lot more...at least, for now.

Still, I've had very positive reception through messages and emails in the last few months in regard to my investment decisions and transparency, especially if its benefited others.

Coming back to the introductory story, I've long shifted the majority of my money into Energy and China/India. The timing on it has been exceptionally good and I expect smaller positive returns in 2023, followed by a large bull run in 2024.

Energy in particular has been more consistent over 1-mth periods, with results consistently surpassing my expectations.

My present DCA is also into Energy, China and India. Since End October till now, the results have been quite significant, achieving between 8 to 25% returns. While it's a far cry from my peak Unit Trust Investment gains of the last 5 years (which need about a 65% gain to get back up), it's a good start as any.

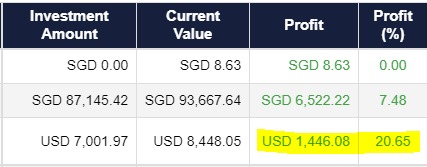

One notable feature is my experiment into a leveraged Energy portfolio, which I'm using a small amount of OPM to test out. The result of 20.65% was achieved in a little under 3 weeks.

It has largely gone sideways since, moving up and down by as much as 13% up and down from the screenshot, but somewhat staying there. I'll likely be holding it into 2023.

I think 2022 was humbling, but it's also restored my confidence as an investment trainer. For the most part, I was able to mitigate the majority of further losses within 6-7 months and determine profitable allocation around that time as well.

Today, my personal track record still stands at 32.088% annualized returns from 2017 to 2021, or around a 300% gain in 5 years. I've taught consultants with integrity how to duplicate my methods and if you're a suitable client, I'd love to see you reap the benefits of these effective, long term investment strategies.

If anyone is looking to invest with direction, confidence and certainty, you can always drop me a message and I'd be happy to offer my informed opinion.

Do feel free to contact me at 91769099.

Money Maverick

Comments