I Got A Call From MAS After Waiting 5 Years - AFTER They Warned Finfluencers...?

- Sep 25, 2025

- 9 min read

People. Seriously. I know that I haven't been writing very much, or at all. Frankly, I've been up to a lot, despite the fact that I really do love writing.

But compared to when I was an FA, I write a lot less. I used to write and publish weekly. I used to conduct my research on the buses and trains in between appointments, or even in the toilet - and then flesh out a lengthy, well-researched article with evidence for my obviously biased position. Bias is not an indication of malice or something that should necessarily diminish your credibility. It simply means that you have a view on life that can run in opposition to others and you have the evidence to support why you think life, or finance, should be that way.

If it is presented in a compelling and authentic manner, people will believe you. That is why I was able to cultivate a reasonably good career and business partners through this blog. But when I was an FA, regulation for social media was so new that anyone could leave an anonymous complaint to MAS, clip something I wrote out of context like part of an article or part of a comment on Facebook and then send it to MAS. MAS would feed it back to my compliance department, where I had to explain the context for each part and painstakingly dig into something that I had written years ago or explain the context for each thing written. It was so egregious to the point that I wrote about it almost 5 years ago here: I Got Reported to MAS Over 120 Times! (by the same person) - Business Analysis, Personal Update And for whatever reason, most compliance departments as far as I can tell are so far less financially proficient than FAs, that I have to explain the articles to such a maddening degree SO THAT THEY CAN FIND SOMETHING TO PIN ON ME. It was ridiculous. And for years, I was so angry and frustrated and I wanted to explain myself to someone who I thought would be much more intelligent or could judge better, which was obviously the people reported to: MAS. And so, years after leaving the industry (now I can say it as a plural) and almost 5 years after I received a ridiculous amount of malicious and anonymous reports, I got a call from MAS.

The Call

Firstly, I have huge respect for telemarketers.

So even if I know its one - the extension might start with 65 2...I STILL PICK UP.

I always want to reject them nicely, although I will usually start more gruffly (who is this, what do you want). If it can be articulated clearly, I will reject them politely - because as an advisor/rep it was always heartbreaking to be rejected without explanation or rudely.

So I picked up, and to my surprise it was an MAS lady. At first, I thought it was a crank call or that I was dreaming - because I was in my bed slightly sick, and it was the middle of the afternoon.

The summary of the call was as follows:

1) MAS was doing screenings of finfluencers, and they had flagged out Money Maverick's articles 'potentially'.

2) I was not in trouble in any way, shape or form - this was important to ascertain. The articles were also not specified, in the call at least.

3) MAS had absolutely no clue who I was or my background, at least as far as the conversation went. This was disappointing to me because while I can't claim that I would look good in their eyes on paper, there should certainly be some common sense that it's not NORMAL for someone to be reported that often, even if you are the worst agent on earth.

4) I was heavily encouraged to come down for a meeting at HQ where I would be briefed or educated on the potential risks of certain things that could lead to being in trouble in the future, and I could also freely offer my feedback to MAS. An email was sent to me to confirm my appointment.

My response was as follows:

1) The context of most of my more popular articles is during my time as a financial advisor, which the regulations for writing were not necessarily clear at the time. Some of them have been republished after I bought back my blog and stopped my practice, but I was seeking examples of my potential risks which she was not willing to brief over the phone. 2) I re-ascertained that I was not in trouble and pointed out that Money Maverick has not even published 10 articles in 2 years, and my reach and influence has dropped tremendously - while even at my peak, it was not particularly far reaching. I stated that I did not think this was a good use of MAS resources and they were free to publicize more openly about any new regulations they were coming up with for finfluencers. 3) I reiterated that I did not, will not, ever consider myself a finfluencer. 4) I eventually agreed to come down a few days later - which strangely enough, was the same day that local news has published THIS ARTICLE: Singapore

Despite agreeing to come down initially to the meeting, I decided not to after some consideration that was largely from Loo Cheng Chuan's YouTube Video and Christopher Tan's article on ILPs, which I thought that both were quite erroneous, misleading and insulting. I say this with a reasonable amount of respect for the latter, so I don't mean it as a personal attack, but it just came across as poorly written and delivered.

That made me seriously consider why was I putting myself through all this trouble when I hadn't even published anything in months! It was the same old story, different tune, and I wasn't even a financial advisor representative anymore. -__-"

Now to be clear, I was NOT one of the content creators and I did not receive any advisory letters. I would not be SURPRISED if I received advisory letters, but at this point I have become such a jaded cynic that I could hardly care less about my freedom of expression, if any - since no authority ever wants to read my articles fully or dissect the evidence provided as intended.

I also want to be clear that I fully respect the MAS caller, who was nothing but polite and understanding to me, and she did nothing wrong. In fact, part of the reason I agreed to it initially was because I was worried that she was just doing her job and she might experience difficulty if I didn't attend, which is something that I tend to feel overly responsible for.

I think frankly even if it's quite late, it's very encouraging to see MAS take soft steps to handle a situation that has been long ongoing where irresponsible finfluencers have had far, FAR more damage on the Singapore population than licensed FA Representatives.

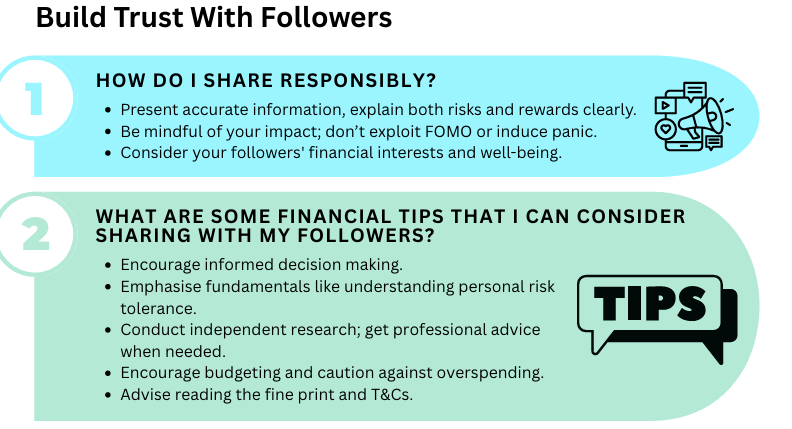

MAS has published this soft guideline here:

7 Must-Knows When Sharing Financial Information Online

What's Next For 'FinFluencers', and For Us?

1) Don't Celebrate: As a former FA rep I'm obviously in support of this to some limited degree, but there are already several issues with such a simplistic document, such as Definitions.

Similar to what I argued with my incompetent compliance departments back in the day, what is 'Responsible'? If I say I didn't FOMO anyone and you say that I did, who is correct? Is FOMO a particularly charged headline or 6 paragraphs of evidence showing that you SHOULD be FOMO-ing?

What is 'Recommend'? You have to remember that Seedly back in the day wrote articles and hosted forums discussing and encouraging DIY solutions and very specific products/topics, which includes:

1) Luna Terra, which eventually crashed. I'm not too hard on them for this one, I'm not under the impression they hard-sold it, but they certainly had a great influence over their community getting it.

2) FTX

3) P2P Platforms that crashed, which were heavily advertised, reviewed to be #1 and promoted on the site, such as CoAssets, BRDGE and the like.

I actually would NOT hold them responsible for the outcomes - and some of them are LIFE-SHATTERING, 'SET YOUR RETIREMENT BACK YEARS' OUTCOMES - but when I look at how some Financial Advisors sell compared to how these products were discussed and promoted, how is that any different from leading to a recommendation? There are certainly incentives involved as well, so how do you define recommend?

Ultimately, I do think that there will be plenty of work down the line, and nothing will change yet.

2) Why not Name the FinFluencers?

The Finfluencer space has been so obvious and prevalent - Financial Coconut, Budget Babe, Seedly, Kyith, Financial Horse, Christopher Ng, etc.

Some of them are obviously much more credible than others, and yet some of their articles or talks/podcasts (audio basically) on certain topics are so egregious, misleading and self-serving that Financial Consultants have been calling them out for the better part of TEN YEARS. The reason why it would be useful to name them is to demonstrate that this effort to seriously look out for the local population's welfare is SUPPORTED BY EVIDENCE.

The space is so obvious that any Financial Consultant in this space for over the last few years could tell you IMMEDIATELY that if MAS named the finfluencers in question, they would know:

a) What they did to get the warning

b) What the topic was LIKELY about

c) Other similar topics

A warning also means very little in the sense that it could be disputed as to why there was a warning to begin with. That was another reason I did not want to engage at all - the context of my messages was important.

I had to be repeatedly cleared by compliance departments, lied to by some supervisors as to what was publishable, anonymously reported for maliciously clipped content and till today YEARS after my career there is still little to no evidence that my articles were fundamentally misleading aside from 'We have found/We have come to the conclusion that you were wrong'.

Conversely, on my social media feed, there has been plenty of pushback when it's very obvious how some things are clearly misrepresented to the point that prominently figures in the FA space have had to write counterpoints or even go on Money FM to push back on something egregious. To quote a particularly good one:

"Are we to assume that such large numbers of Singaporeans lack the ability to exercise sound judgment? 这趋势明显显示不只是一小组人"无知". The implication here is that entire swathes of consumers were gullible or uninformed, which is an extraordinary and frankly insulting claim."

By naming the parties in question, it will allow them to put out their point of view on the matter as well as let others decide for themselves, while allowing their critics to provide any supporting evidence or rebuttals.

3) What Does This Mean For Me As a Consumer?

Wake up. Finfluencers are not your role models. In fact, some of them are born from the ashes of huge scammers - the US scene for Finfluencers had made that much very prevalent. Whether or not you get your news and advice from a Finfluencer or Financial Advisor - TAKE RESPONSIBILITY. MAS should not have to do this now - they should have done it years ago. We should all have realized by being burned by bad finfluencers over and over again that when someone disclaims to Do your own Due Diligence, they are not kidding. We live in the most technologically advanced age of all time, and we are the most educated we have ever been. There are little to no excuses. If you must make any financial decisions. have deep, meaningful conversations with people who show you that you can trust them and more importantly, bear some of the burden of responsibility for influencing that decision you make. For example, will someone who recommended the SNP500 on a forum be able to take a call with you to tell you why it has not 'gone wrong' if it dips by 15%?

Perhaps then, it doesn't seem like a very wise decision to follow this blindly, now does it? Closing Thoughts

My hope of course is that some people will take these warnings seriously and we won't really go back to a cowboy age of saying whatever you want recklessly, especially if it is FACTUALLY incorrect. That is my point of contention. I'm not even that concerned if people hate ILPs or hate various investment modes, or perhaps you believe Property is the best and stocks such - it really DOES NOT MATTER. What matters is whether your article is accurate.

Misleading is too general - if people take action, it just means you are convincing.

And I want people to be convinced because of evidence, not because they have professional qualifications or have a huge influence (for example, leeching off owners who bought your company repeatedly for years and funded a ton of money to make your platform work).

MAS deserves credit for taking action in the right direction. I'm hoping its not years too late.

Money Maverick

An adr courses provides essential understanding of hazardous materials transport. Regulatory knowledge supports safe operations across logistics and supply chain environments. The college of contract management delivers industry-focused education with clear learning outcomes. Courses are designed to support career progression.

This was an insightful read about MAS and the finfluencer situation thanks for sharing! I couldn’t help but wonder, Angela Vint Zodiac Sign traits like curiosity and communication skills might make her a thoughtful voice in financial discussions. It’s a reminder that personality and context matter when interpreting experiences and stories online.

Professionals who understand risk often lead stronger projects. The College of Contract Management focuses on construction risk management that supports better control and planning. The learning is grounded in industry reality.